Plywood Press Investment Analysis: A Case Study for Albany Building Supplies

Plywood Press Investment Analysis: A Case Study for Albany Building Supplies

Emily Jones, a recent graduate of Massey University, has joined Albany Building Supplies (ABS), a timber firm based in Albany, north of Auckland. She's been tasked with a critical project: evaluating two new plywood presses, the Nakoi and Dakota, to determine which, if either, ABS should purchase.

Thomas Wilson, ABS's General Manager, presents Jones with the challenge, highlighting his company's reliance on the timber industry and his preference for projects that align with their core business. He shares his 'Fixed Asset Purchase Guidelines' (FAPG), which emphasize payback analysis for smaller investments and a combination of payback and average accounting rate of return (AARR) for larger ones.

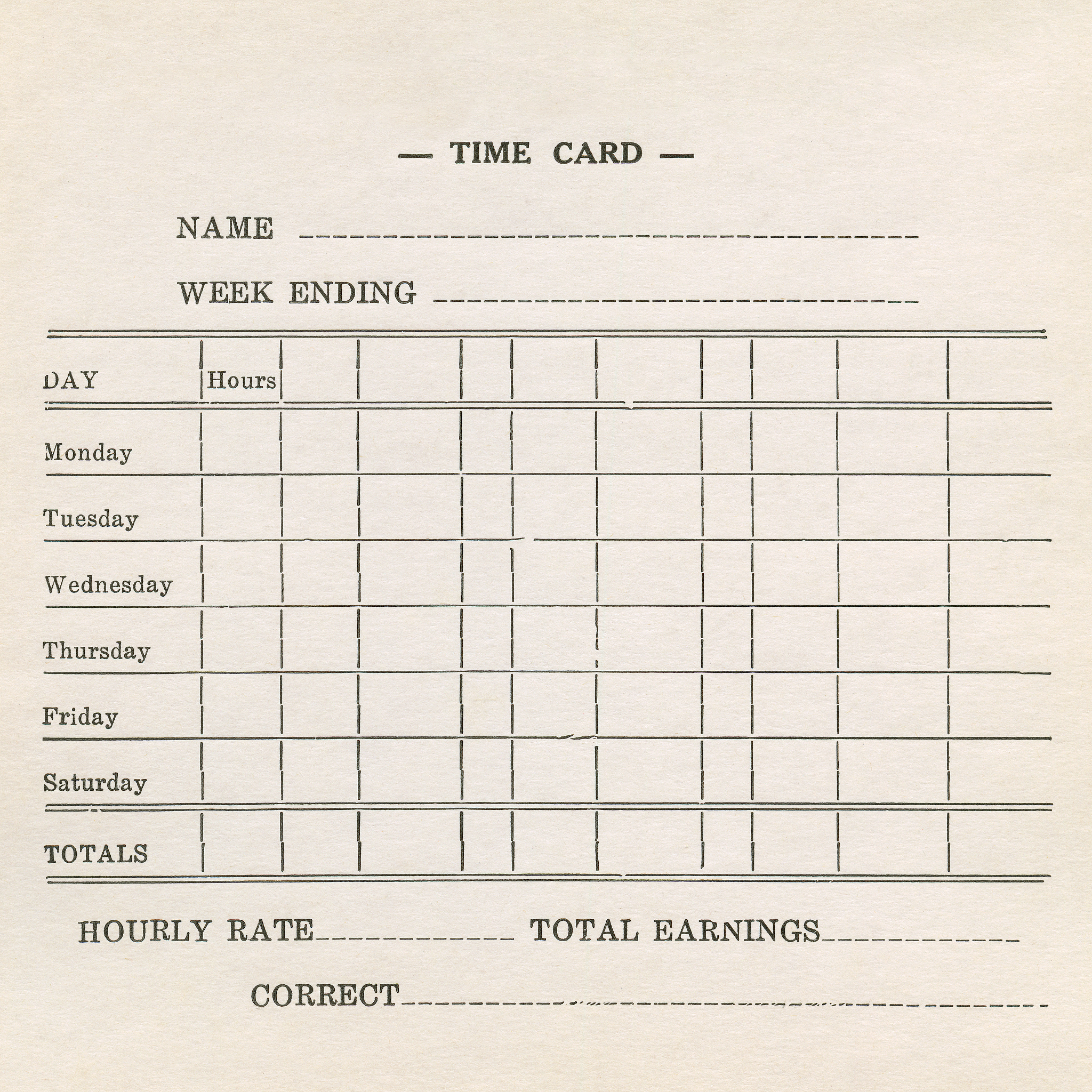

Jones is tasked with analyzing the financial viability of both presses. Exhibit 1 provides detailed information on each machine, including their production capacity, costs, and residual values. Wilson emphasizes the importance of accurate forecasts, employing a rigorous approach to ensure that projections are not overly optimistic. He also indicates that while ABS currently uses a 20% target book return, a 15% market return might be considered for projects with substantial potential.

Jones's Evaluation

Jones begins her evaluation by applying the initial information provided in Exhibit 1. However, Wilson subsequently revises the assumptions, suggesting that the selling price of plywood increases by 4% per year, cash costs also rise by 4%, material costs constitute 72% of sales, and the appropriate discount rate is 17%.

Jones uses this revised information to calculate the net present value (NPV) of each machine. The Dakota emerges as the better investment due to its higher NPV. However, Jones recognizes the sensitivity of NPV to changes in growth rates and discount rates.

She then explores various scenarios, varying the growth rates of both selling price and cash costs. The results reveal that the Dakota consistently has a higher NPV across most scenarios. However, there are instances where the Nakoi's NPV surpasses the Dakota's, particularly when cash costs increase faster than selling prices.

Key Takeaways

The case study highlights the importance of:

- Thorough financial analysis: Utilizing a range of capital budgeting techniques, including NPV, payback, and AARR, is crucial for informed decision-making.

- Sensitivity analysis: Evaluating the impact of changes in key assumptions, such as growth rates and discount rates, helps understand the potential risks and rewards associated with each investment.

- Accurate forecasting: Maintaining a culture of honest and realistic forecasting is critical for achieving accurate project evaluations and avoiding overly optimistic projections.

- Alignment with company strategy: Investment decisions should align with the company's overall mission and strategic goals, ensuring that projects contribute to long-term success.

Conclusion

Through this analysis, Emily Jones provides valuable insights into the financial viability of each plywood press. The case study underscores the complexities of capital budgeting decisions and the importance of careful evaluation and consideration of alternative scenarios. It serves as a valuable reminder that informed decision-making requires a thorough understanding of the underlying financial assumptions and their potential impact on investment outcomes.

(Note: This case study is a simplified example and does not constitute financial advice. Real-world investment decisions would require more extensive analysis and consideration of a wider range of factors.)

[The final question will require you to prepare an Excel spreadsheet to illustrate the calculations made.]

原文地址: https://www.cveoy.top/t/topic/f1wU 著作权归作者所有。请勿转载和采集!