1What does a statement of Cash Flows show 2Why is it important to reduce negative cash flow 3What are three future income targets and three expense targets commonly based on 4What are some examples of

- A statement of Cash Flows shows the inflow and outflow of cash in an organization over a specific period of time.

- It is important to reduce negative cash flow because it can lead to financial distress, inability to pay bills and debts, and ultimately bankruptcy.

- Three future income targets that are commonly based on are sales projections, market trends, and new product development. Three expense targets commonly based on are cost-cutting measures, budget constraints, and operational efficiency.

- Examples of income and expense research methods include market research, customer surveys, financial analysis, and benchmarking.

- Financial management is important because it helps organizations to plan and allocate their financial resources effectively, make informed decisions, and achieve their financial goals.

- Financial software management is used to manage financial information and perform tasks such as accounting, budgeting, forecasting, and financial reporting.

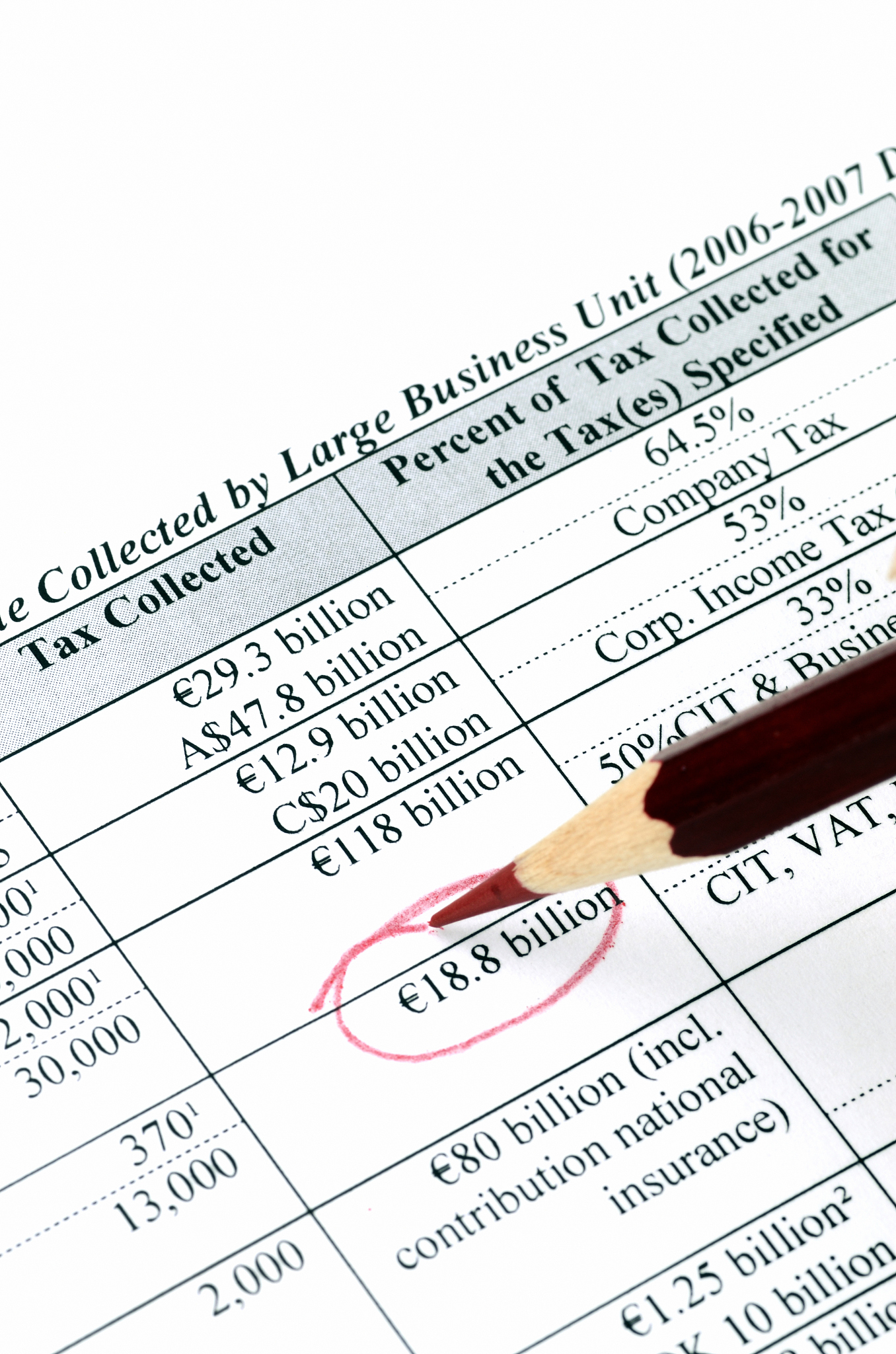

- Some types of taxes a company or individual must pay include income tax, sales tax, property tax, and payroll tax.

- In a financial report, sections that can be normally found include an executive summary, financial statements, analysis of financial performance, and recommendations for improvement.

- A good financial analysis report should consider three factors: accuracy, relevance, and timeliness. It should also provide actionable insights and recommendations.

- Key financial issues that need to be addressed in a financial report include profitability, liquidity, solvency, and efficiency. These issues should be analyzed and solutions should be proposed to improve the financial health of the organization.

原文地址: https://www.cveoy.top/t/topic/bUGu 著作权归作者所有。请勿转载和采集!